In the rapidly evolving world of cryptocurrencies, Ethereum has carved out a significant niche, not only as a digital currency but as a platform enabling decentralized applications and smart contracts. For enthusiasts and investors aiming to mine Ethereum profitably, choosing the right rig becomes paramount. Mining rigs—comprising powerful GPUs, specialized motherboards, and efficient cooling systems—are the engines driving the validation of transactions and earning Ether as rewards. But with myriad options flooding the market, how does one discern the best Ethereum rig prices without compromising on performance? This guide dives deep into what makes an optimal mining rig, the factors influencing prices, and how hosting services could amplify one’s mining venture.

Ethereum mining rigs differ substantially from Bitcoin miners, as Ethereum’s Ethash algorithm rewards memory bandwidth rather than pure hash power. Consequently, rigs flaunting multiple high-end GPUs like the NVIDIA RTX 3080 or AMD’s RX 6800 XT become the standard bearers. Costs fluctuate widely depending on GPU availability, brand, and configuration. While an entry-level rig might cost from $1,500 to $2,500, optimized setups can soar beyond $10,000, especially when factoring in custom cooling solutions or cutting-edge motherboards facilitating 6-8 GPU integration.

What’s more, the aftermarket for used GPUs has surged due to the pandemic-induced chip shortages combined with bullish crypto sentiments, inflating rig prices in a volatile market. Buyers must tread carefully, balancing between pricing and long-term ROI. The most fruitful endeavor involves purchasing components with substantial hash rates and lower power consumption, crucial to turn a profit in the face of rising electricity costs across many regions.

Hosting mining rigs presents an intriguing alternative to buying rig components outright, particularly for miners who lack the physical space, technical know-how, or favorable electricity rates at home. Professional hosting services operate large-scale mining farms offering infrastructure, maintenance, and optimized conditions to keep rigs running at peak efficiency. These services can collectively reduce downtime, improve cooling, and harness economies of scale to lower operational costs.

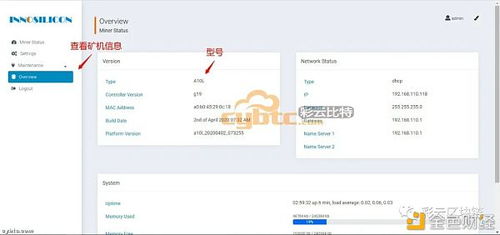

The synergy between hosting solutions and mining rigs empowers individuals to tap into the mining ecosystem seamlessly. Furthermore, some hosting services provide real-time dashboards and remote access, granting miners extensive control and transparency over their investments. This model is particularly advantageous amid fluctuating ETH prices, enabling miners to adapt swiftly without the burden of hardware logistics.

With the scheduled transition of Ethereum from Proof of Work (PoW) to Proof of Stake (PoS) anticipated to reshape mining dynamics significantly, prospective buyers should also consider the longevity of investing in mining rigs now. Even though the shift toward Ethereum 2.0 threatens the traditional mining landscape, numerous altcoins retaining GPU-based PoW mechanisms remain lucrative. Versatile rigs, with GPUs capable of switching between mining Ethereum and other coins like Ravencoin or Ergo, diversify risk while maximising hardware utility.

Cryptocurrency exchanges complement the mining ecosystem by providing liquid markets for mined tokens. Miners often rely on exchanges such as Binance, Coinbase, or Kraken to convert mined ETH into stablecoins or fiat currencies, ensuring timely profits and hedging against price volatilities. Integration between mining software and exchanges increasingly automates payouts, streamlining the entire operation from mining to cashout.

Interestingly, the rising prominence of tokens like Dogecoin and Bitcoin often entices miners to repurpose rigs or explore hybrid strategies encompassing multiple coins. While Bitcoin mining relies on ASICs optimized for SHA-256 hashing, Ethereum and similar altcoins benefit from flexible GPU rigs. This divergence underscores the criticality of understanding hardware compatibility when hunting for the best rig price versus performance ratio.

In closing, navigating the Ethereum mining rig market demands a multidimensional approach: analyzing hardware specs, assessing energy efficiency, comprehending hosting opportunities, and staying abreast of blockchain protocol shifts. Buyers armed with this knowledge can select rigs that not only offer competitive prices but also ensure sustainable mining profitability in the fast-paced crypto terrain. Whether building from scratch, upgrading existing setups, or leveraging hosted mining farms, the quest for the ideal Ethereum rig continues to pulse at the heart of decentralized innovation.