Dogecoin, that whimsical cryptocurrency born from an internet meme, has captured the hearts of many since its inception in 2013. But beyond the canine charm lies the intricate world of mining, where individuals and companies alike invest in the pursuit of processing transactions and securing the network. As miners embark on this journey, understanding the mining difficulty and profitability at home becomes crucial. Let’s dive deep into the metrics that govern Dogecoin mining today, factoring in the dynamics with Bitcoin, Ethereum, and mining machines.

Mining difficulty is a term that crops up frequently in the cryptocurrency landscape. It essentially measures how hard it is to find a new block. On the Dogecoin network, difficulty fluctuates based on collective hashing power – the total computing power dedicated to mining at any given moment. This prevents any single miner from dominating the process, thus maintaining the equitable spirit of this currency. In contrast to Bitcoin, which also sees periodic adjustments, Dogecoin’s mining difficulty changes are influenced by a smaller community of miners, which can lead to sudden swings in profitability.

To understand profitability in home mining, one must weigh several factors: electricity costs, hardware efficiency, and the current market price of Dogecoin. A mining rig, that engineering marvel of chips and power supplies, can vary significantly in performance based on its design and configuration. In the ever-evolving landscape of mining machines, dedicated ASIC miners have proven their prowess in producing Dogecoin efficiently, much like dedicated rigs for Bitcoin mining have dominated that space. However, the entry point for investing in specialized equipment can be steep, which raises the question of whether home mining remains a viable option.

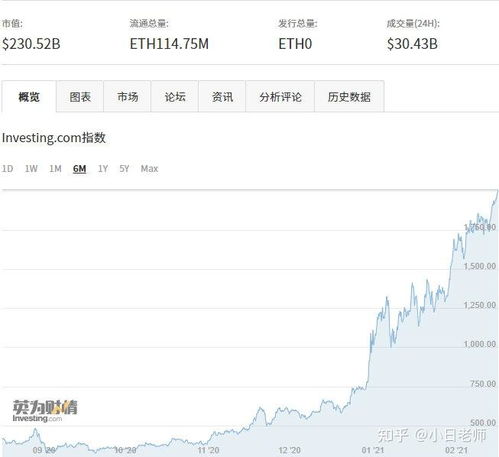

In the world of cryptocurrency, timing and market conditions are everything. Bitcoin, Ethereum, and other major currencies experience significant price fluctuations, directly affecting mining profitability. When Dogecoin surges in value, those mining it may find their returns swell; conversely, during bear markets, profitability can plummet, leaving home miners facing uncertain margins. It’s crucial to stay informed on current trends, as well as strategies that could enhance profits. For those keen on mining Dogecoin, it might be beneficial to consider joining a mining pool—combining efforts with others to mine more effectively and receive smaller, more consistent payouts.

But what are the alternatives to home mining? The rise of mining farms has reshaped the landscape considerably. These massive operations house numerous rigs operating at once, leveraging economies of scale. When one factors in infrastructure, maintenance costs, and expert oversight, small home miners must question their ability to compete. The allure of a mining farm comes in its consistent power supply and the potential for higher returns, lessening the burden of intermittent earnings seen in home mining. As the market evolves, this decision is paramount for those invested in dog-themed cryptocurrencies.

As the digital frontier expands, more users flock to crypto exchanges, buying and selling currencies not merely for investment but as part of a diversified portfolio. Home miners must recognize that their continued success in mining Dogecoin, Bitcoin, or Ethereum—whatever their focus—may hinge on the health of these exchanges and market sentiment. Platforms that offer transparency and security for transactions encourage wider adoption, strengthening the ecosystem for all participants, from miners to traders alike.

Moreover, staying updated with developments like Ethereum’s transition to Proof of Stake further complicates the mining narrative. Some miners may shift focus between different currencies, while others may explore hosting services for their rigs. The concept of mining machine hosting presents a unique opportunity: renting out space and resources in professional setups can afford miners the benefits of reduced overheads while maintaining operations in a competitive marketplace.

As we navigate through the complexities surrounding Dogecoin mining, it’s evident that profitability and success depend on so many intertwined factors. Future advancements in technology and shifts in community focus—be they towards alternative currencies or more robust mining solutions—will inevitably create ripples in the market. While the playful Dogecoin meme might have started as just a digital joke, its ramifications in the mining sector cannot be understated. Equip yourself with knowledge, make informed decisions, and who knows? You might just find a golden opportunity in the world of blockchain and cryptocurrency mining.