As the digital gold rush intensifies, Bitcoin mining machines have cemented their place at the heart of the cryptocurrency ecosystem. With 2025 looming on the horizon, investors, miners, and tech enthusiasts eagerly scrutinize price trends that could redefine the mining landscape. Unlike the unpredictable swings of cryptocurrency prices themselves, the cost and availability of mining rigs exhibit a distinct rhythm influenced by semiconductor advancements, energy costs, and geopolitical factors.

Bitcoin’s blockchain, the relentless ledger that processes transactions and secures the network, owes its vitality to miners. These miners rely on a fleet of specialized hardware—mining machines—that perform the cryptographic puzzles fundamental to validating new blocks. The evolution of mining rigs from bulky CPUs to advanced ASIC devices has been remarkable, echoing the technological arms race that characterizes this space.

Entering 2025, the manufacturing complexities tied to production chips, heightened demand for efficient rigs, and supply chain constraints push the price needle in compelling ways. The advent of next-generation ASIC models promises increased hash rates and lower power consumption—key performance metrics that can tilt profitability scales. However, scarcity and component shortages may elevate upfront costs, erecting barriers for small-scale miners aiming to enter or expand their operations.

Parallel to hardware costs, the hosting aspect—where miners place their machines in specialized data centers—undergoes its own transformation. Hosting facilities now emphasize optimized cooling, renewable energy utilization, and security enhancements. This evolution not only reduces operational expenditures but also aligns with the growing scrutiny on Bitcoin’s environmental footprint. Consequently, miners opting for hosted solutions can better forecast expenses and amplify uptime, enhancing their competitive edge in the volatile market.

It’s also worth noting how these price trends interplay with fluctuations in cryptocurrency valuations. Bitcoin’s own market trajectory often catalyzes surges in mining hardware demand, as bullish runs entice a new wave of participants. Conversely, prolonged price downturns can saturate the mining rig resale market, offering opportunities for bargain acquisitions but also pressuring manufacturers to innovate or risk obsolescence.

Meanwhile, altcoins like Ethereum and Dogecoin, each with distinct consensus mechanisms or hashing algorithms, indirectly influence the Bitcoin mining hardware sector. Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS), for instance, has freed up GPU mining capacity, affecting the economics of hardware production and resale markets. Conversely, Dogecoin’s merge mining compatibility with Litecoin fosters an intriguing dynamic where some miners diversify operations to enhance returns, indirectly shaping hardware demand and deployment patterns.

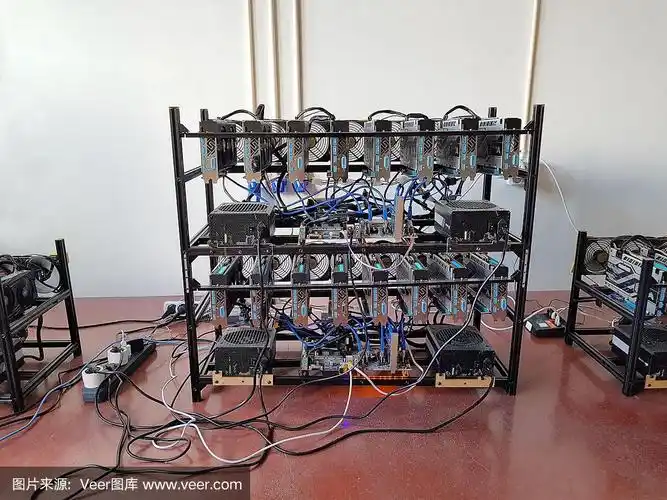

As mining farms continue to mushroom globally, large-scale operations jockey to harness economies of scale, negotiating favorable hardware pricing and electricity rates. These mining farms, often sprawling complexes filled with rows upon rows of humming miners, epitomize the industrialization of mining that began over a decade ago. Their presence not only shifts price dynamics but also sets benchmarks for mining efficiency, forcing individual miners to reconsider whether direct hardware ownership or hosted mining better suits their risk appetite and investment horizon.

Exchanges and cloud mining platforms also impact the hardware landscape. By offering tailored hosting and mining contracts, they abstract away some complexities and costs associated with owning and operating physical machines. This trend, growing in popularity, nudges the dialogue toward accessibility and democratization of mining opportunities even amidst fluctuating hardware prices, ensuring the ecosystem remains vibrant and diversified.

Looking ahead, geopolitical currents, regulatory frameworks, and technological leaps will continue to sculpt the Bitcoin mining machine market. Factors like chip production policies, international trade relations, and global energy price volatility may cause brief spikes or plunges in hardware costs. Prospective miners and investors should remain vigilant, harmonizing market research, technical insight, and financial strategy to navigate this multifaceted terrain.

In essence, Bitcoin mining machines in 2025 represent more than mere hardware; they are the beating heart of a decentralized revolution. Price trends to watch are not only numerical shifts but signposts pointing toward larger narratives about innovation, sustainability, accessibility, and resilience in the ever-expanding universe of cryptocurrencies and blockchain technology.