In the rapidly evolving landscape of cryptocurrencies, mining remains a critical pillar that supports decentralized networks. But as blockchain technology grows increasingly complex and competitive, individual miners often face a plethora of obstacles—ranging from escalating electricity costs to sophisticated hardware demands. This is where hosted mining services emerge as a beacon of opportunity, especially for Ethereum enthusiasts and those eyeing other promising altcoins. Hosted mining takes the stress out of managing physical rigs by entrusting the upkeep, electricity, and technical maintenance to professional operators. Not only does this alleviate logistical burdens, but it also optimizes hash rates by positioning mining equipment in locations with ideal environmental conditions and cheap power.

Ethereum’s transition through upgrades like the Merge has fundamentally redefined mining paradigms. Yet, many miners remain vigilant in maintaining their ETH mining rigs on Proof-of-Work chains or exploring alternatives such as Ethereum Classic or similar POW coins. For such miners, hosted services serve as an efficient conduit—integrating cutting-edge GPUs or ASIC miners with reliable internet connectivity and cooling systems. These setups drastically reduce downtime—a core factor that directly relates to profitability. Furthermore, hosted mining rentals often come bundled with software packages that allow remote monitoring, ensuring that miners can track real-time performance and earnings without physically tending to every unit.

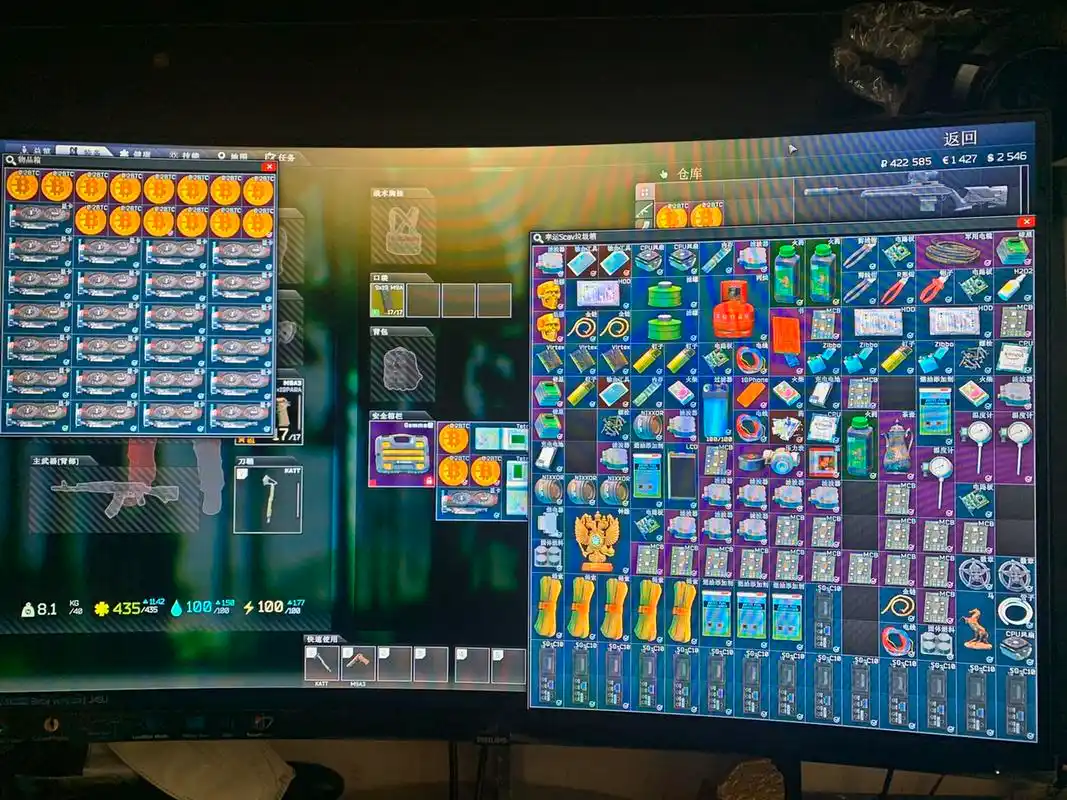

Delving deeper into mining hardware, the choice between ASICs and GPUs continues to be a hot topic. Bitcoin mining, dominated by top-tier ASICs, demands immense computational power best housed in professional mining farms equipped with specialized cooling and ventilation. Conversely, Ethereum mining historically favored high-performance GPUs because of its memory-intensive Ethash algorithm. As the market diversifies, this distinction blurs with the advent of multi-purpose mining rigs capable of switching between different cryptocurrencies depending on prevailing network difficulties and coin prices—a flexibility highly valued by miners in volatile markets.

Mining farms and mining rigs are the backbone of any hosted mining operation. Hosting companies strategically locate their facilities in regions with advantageous energy tariffs and favorable regulations. This global distribution helps minimize latency and maximize uptime, serving clients across continents. Hosting isn’t merely about space rental; it’s about delivering an entire ecosystem—a synergy of power infrastructure, security protocols, and expert technical teams. Such comprehensive service models enable miners who might lack technical expertise or initial capital to engage confidently in mining, democratizing access to crypto mining returns.

Beyond Ethereum and Bitcoin, the cryptocurrency universe teems with diverse coins each with unique mining algorithms and community fits. Dogecoin, for example, continues thriving on a merged mining approach with Litecoin, maximizing miner efficiency by simultaneously validating blocks for two cryptocurrencies. This cross-pollination of mining efforts has not only boosted Dogecoin’s network security but also amplified miners’ profitability without extra investment in hardware. Hosted mining providers increasingly offer packages tuned for a variety of currencies, making it easier for miners to hedge their bets or diversify portfolios through mining multiple coins.

Another vital aspect intimately tied to mining success is the ecosystem of exchanges and wallet services. Mining yields accrue as digital tokens that require secure trade and storage. Top-tier hosted mining firms often integrate real-time exchange APIs enabling users to instantly swap mined coins for fiat or other cryptocurrencies. This seamless integration is pivotal in volatile markets, where timing can dramatically affect revenue. Moreover, some companies provide advisory services, assisting miners in navigating crypto markets and exchange liquidity to optimize proceeds.

Lastly, the rise of decentralized finance (DeFi) and layer-two solutions directly influences mining economics. As transaction fees fluctuate and block rewards adjust following network upgrades, profitability calculations become a moving target. Hosted mining platforms increasingly incorporate sophisticated analytics tools, epidemiological models of network activity, and forecasting modules. These empower miners to make informed decisions about when to deploy rigs, which coins to mine, and when to liquidate tokens. This tech-driven approach, combined with the lowering barriers to entry through hosting, heralds a new era where crypto mining is accessible, efficient, and dynamically responsive to market forces.